Vietnam Retail & E-commerce Market Landscape 2025 and 2026 Outlook

Economic & Retail Landscape

The economy is still growing, but consumer sentiment has clearly shifted to a more defensive stance.

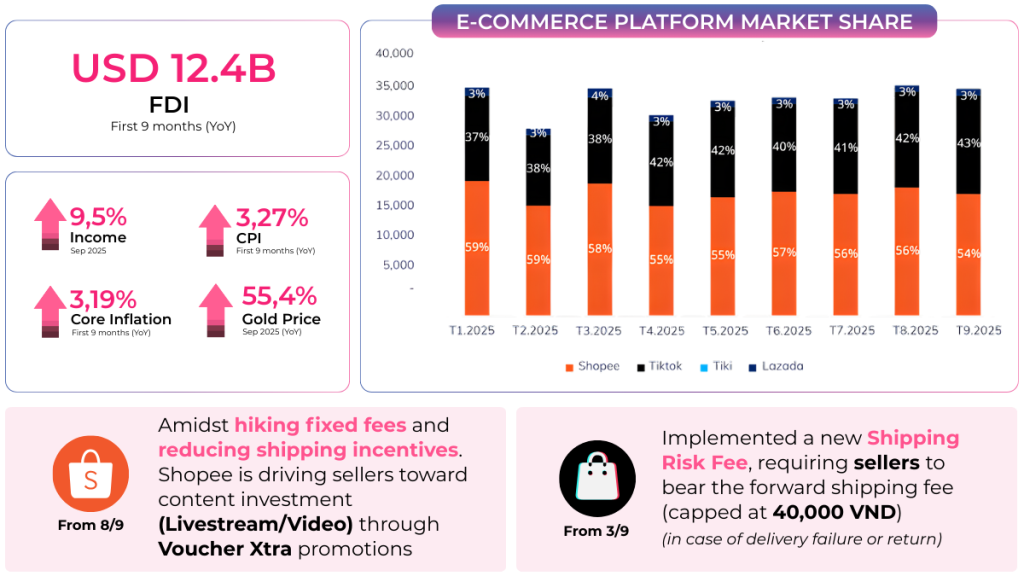

Newly registered FDI in the first nine months of 2025 reached USD 12.4 billion, while CPI rose 3.27% YoY. Meanwhile, gold prices climbed more than 55% YoY—suggesting consumers are prioritizing holding cash and safe-haven assets rather than spending on non-essential items.

On the retail and e-commerce front, growth remains, but the market has entered a consolidation and shakeout phase.

E-commerce platforms are raising fees and scaling back incentives; advertising costs are higher; competition is more intense. The “burn cash to drive revenue” model is no longer viable. Businesses are being forced to shift their focus toward operational efficiency, cost control, and profit margins.

How are consumers changing?

Today’s consumers aren’t necessarily more demanding—but they are less loyal.

Customer satisfaction in retail and F&B is around 7.8/10, yet the customer loyalty rate is only 19–20%. This suggests that many key expectations still aren’t being met consistently.

Gen Y and Gen Z now account for nearly 50% of total spending, and purchase criteria are shifting.

Price is no longer the only deciding factor. Consumers are paying more attention to product quality, ingredients/nutrition, packaging, and the overall experience. Brands that can’t clearly communicate their true value are easily replaced.

2026 Market Outlook

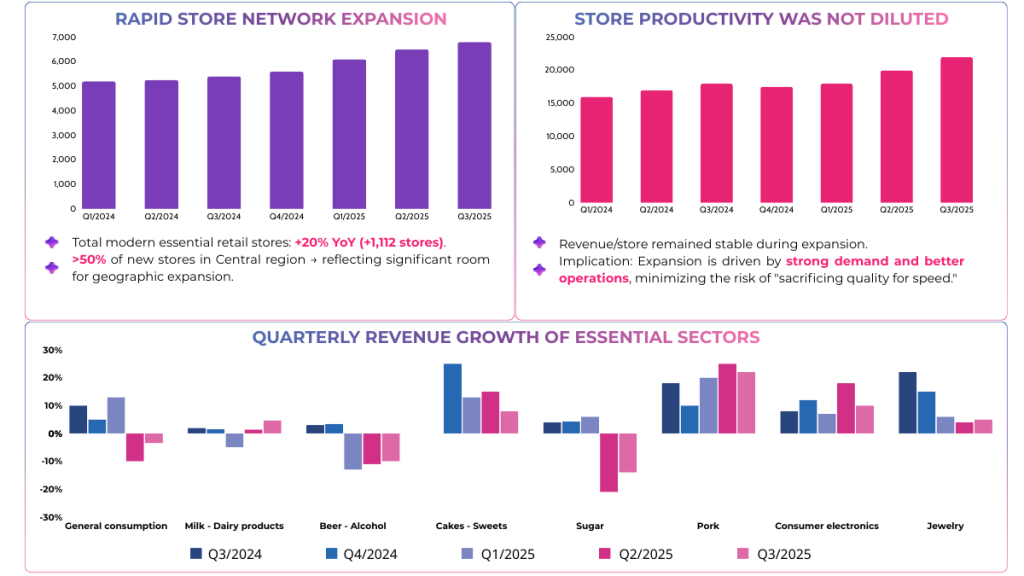

Modern retail—especially in essential goods—still has clear growth opportunities.

The number of modern essential-goods stores is up 20% YoY (an increase of +1,112 stores), with over 50% concentrated in the Central region—indicating significant room for regional expansion.

However, revenue growth in the coming period will mainly come from higher selling prices, not from consumers buying more.

This puts strong pressure on pricing management, margin control, and operational / supply-chain execution. In addition, new requirements to standardize sales channels (such as e-invoicing) may cause short-term disruption—especially for small outlets and traditional retail models.

What does Digital Mind do in this context?

Digital Mind is a consulting and implementation partner for retail and e-commerce businesses in a market that is no longer easy.

We focus on the most core and essential areas, including:

– E-commerce and O2O consulting & implementation

– Multi-channel communications and digital marketing, tied directly to business objectives

– Marketing Automation system design and deployment

– Multi-platform chatbots for sales and customer service

– CRM Automation to manage and activate customer data more effectively

– Website and Mobile App development, plus digital features that support operations and growth

Digital Mind’s goal is not to “make a business look more modern,” but to help businesses run leaner, measure performance, and adapt faster as the market changes.

Download Research Paper

Get full access to this research document